Market Trends

Market Trends

Being able to effectively read the real estate market can save you from making some pretty egregious choices when it comes to making a purchase. Keeping an eye on the trends, interest rates, and knowing when to invest and when not to invest are important factors in a successful run in the real estate industry. Here’s how to read the market for greater success.

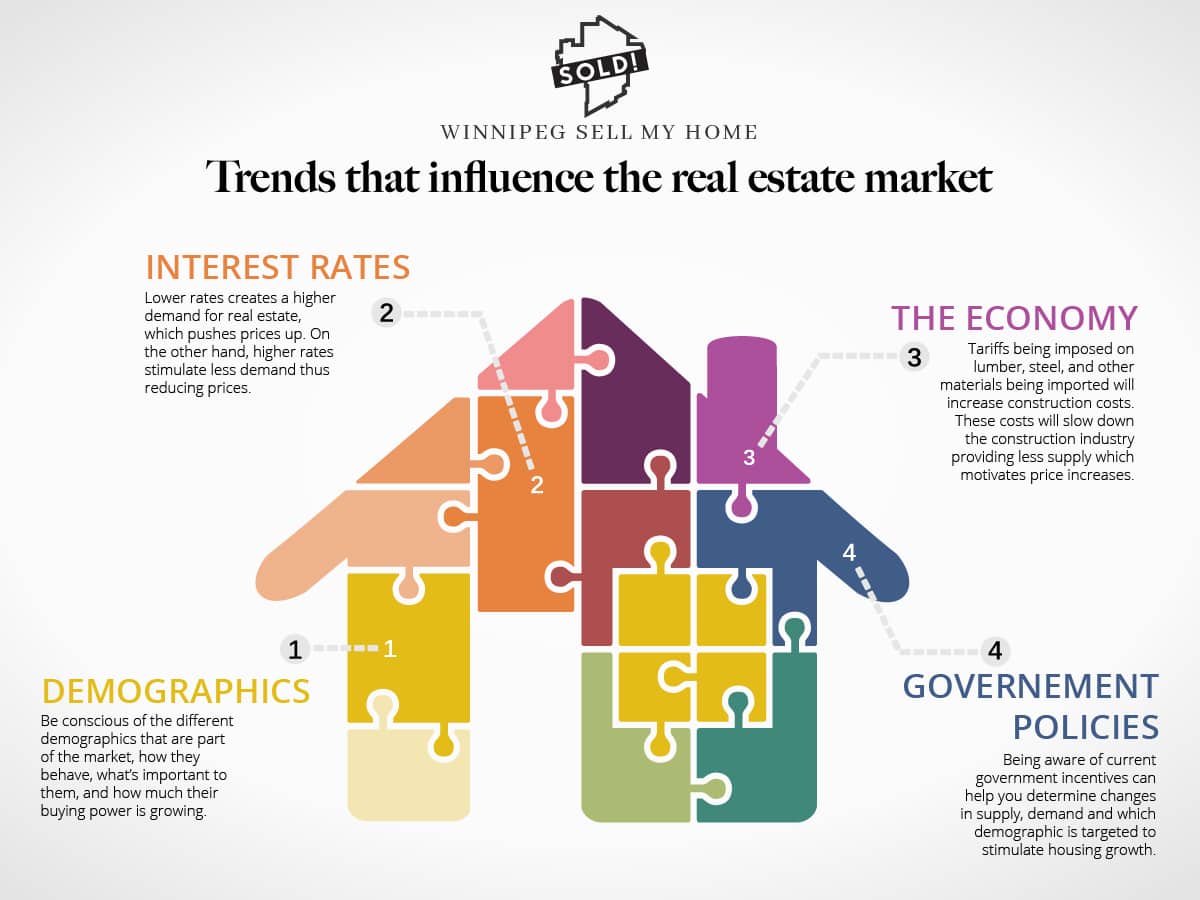

Demographics

Demographics is the study of data that looks at the layout of a population. Specifically looking at the trends in certain neighbourhoods, or towns. For instance age, race, gender, income, migration patterns and population growth are considered in the study. These statistics are an often overlooked but it is a significant factor that affects how real estate is priced and what types of properties are in demand.

This research can tell you specifics that can potentially drive the price of a home or knowing when certain neighbourhoods will available. For example, if the median age in a neighbourhood is over 65, you can expect those properties to be available in the next decade. Consequently, there will be a rise in demand for vacation homes.

Interest Rates

Interest rates play a big role on the real estate market. Changes in interest rates can greatly influence a person’s ability to purchase a mortgage. That is because the lower interest rates go, the lower the cost to obtain a mortgage to buy a home will be. However, lower rates creates a higher demand for real estate, which again pushes prices up. It’s important to note that as interest rates rise, the cost to obtain a mortgage increases, thus lowering demand and prices of real estate.

The Economy

Another key factor that affects the value of real estate is the overall health of the economy. This is generally measured by economic indicators such as the GDP, employment data, manufacturing activity, the prices of goods, etc. Broadly speaking, when the economy is sluggish, so is real estate.

In other words, if the cost of construction goods (lumber, copper, steel, etc.) increase due to import taxes, this will motivate housing prices to rise. In short, a wealthier economy indicates that people earn more in which they spend more.

Government Policies/Subsidies

A considerable factor that influences the real estate market is government legislation and incentives. Tax credits, deductions and subsidies are some of the ways the government can temporarily boost demand for real estate for as long as they are in place. Being aware of current government incentives can help you determine changes in supply and demand and identify potentially false trends.

In 2019, The government of Canada released a First-Time Home Buyer Incentive. This incentive reduces the challenges younger generations face of purchasing affordable housing and a good place to live. This is done by alleviating their monthly mortgage price. Read more about the incentive here.

Conclusion

I hope this sheds some light in understanding a few factors that contribute to the complexity of the real estate market. This article introduced some factors that play a significant role in moving the real estate market, but there are also more complex parts that come in to play. However, understanding the key factors that drive the real estate market is essential to make an educated decision of a potential investment.

Reading Real Estate Market Trends

Being able to effectively read the real estate market can save you from making some pretty...

Knowing When You Are Ready To Sell

It's a hard thing to knowing exactly when you are ready to sell your home. It’s never an easy...

How to Sell Your House Fast

Selling your home quickly should always be the primary focus, no matter the degree of motivation you have. The golden rule of any real estate transaction applies here – “the longer your property stays out there on the market, the more it’s value deteriorates”.